Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions is a comprehensive & insightful resource that aims To unravel The complexities behind payment plan terms & conditions. This guide provides readers with a clear understanding of The fine print that often accompanies payment plans, enabling them To make informed decisions & avoid potential pitfalls or misunderstandings. From explaining common payment plan terminology To delving into The specific terms & conditions offered by various providers, this guide equips readers with The knowledge needed To navigate The payment plan landscape with confidence.

Demystifying the Fine Print: A Comprehensive Guide to Payment Plan Terms and Conditions. Discover everything you need To know about payment plan terms & conditions in this comprehensive guide. No more confusion or hidden surprises – let us demystify The fine print for you. Simplified language, conversational tone, & no jargon. Your go-To resource for understanding payment plans, written for humans.

What is Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions & how does it work?

Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions is a valuable tool that helps consumers understand The often complex & confusing terms & conditions associated with payment plans. It provides a thorough explanation of The various clauses, fees, & obligations that come with these plans, ensuring that individuals have a clear understanding of what they are signing up for.

The idea behind Demystifying The Fine Print is To empower consumers by demystifying The language used in payment plan agreements. It aims To simplify The legal jargon & make it more accessible To The average person. By breaking down each element & explaining its implications, this guide helps individuals make informed decisions about their financial commitments.

A brief history of Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions

The concept of demystifying The fine print has been around for decades, but it gained significant attention in recent years due To The increasing complexity of payment plan terms & conditions. As companies introduced more intricate rules & regulations, consumers struggled To comprehend The implications. This led To a rise in disputes & dissatisfaction.

Recognizing The need To address this issue, experts in consumer advocacy & financial education collaborated To develop a comprehensive guide that would serve as a valuable resource for individuals navigating The intricacies of payment plans. The result was Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions.

How To implement Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions effectively

Implementing Demystifying The Fine Print effectively starts with making The guide easily accessible To consumers. Companies should ensure that The guide is readily available on their websites & provided To customers when they enter into payment plan agreements. It is essential To communicate The availability & importance of The guide To customers, encouraging them To review it thoroughly before making any commitments.

Additionally, companies should consider offering educational seminars or workshops To help individuals better understand payment plan terms & conditions. These sessions can provide an opportunity for in-depth discussions & clarifications, further enhancing consumer awareness.

The key benefits of using Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions

The benefits of using Demystifying The Fine Print are numerous. First & foremost, it promotes transparency & trust between companies & their customers. By providing a clear explanation of The terms & conditions, companies demonstrate their commitment To open communication & fair practices.

Furthermore, Demystifying The Fine Print helps consumers avoid hidden fees & unexpected obligations. It highlights potential pitfalls & ensures that individuals are fully aware of The financial implications of their decisions. This empowers customers To make informed choices & avoid unpleasant surprises down The line.

Challenges associated with Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions & potential solutions

One of The challenges in implementing Demystifying The Fine Print is ensuring that individuals actually take The time To read & understand The guide. Many consumers tend To overlook The importance of reviewing terms & conditions thoroughly, leading To misunderstandings & dissatisfaction.

To address this challenge, companies can adopt various strategies. One approach is To emphasize The significance of The guide during The purchasing process, encouraging customers To read it before proceeding. Companies can also provide concise summaries or key highlights To capture The attention of individuals who may not have The time or inclination To read The entire document.

Future trends & innovations expected in Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions

As technology continues To advance, future trends & innovations in Demystifying The Fine Print are likely To focus on enhancing accessibility & usability. Interactive online platforms may be developed, allowing users To navigate through The guide more easily & search for specific information.

Furthermore, artificial intelligence & machine learning algorithms could be utilized To analyze & summarize The terms & conditions automatically. This would provide users with a simplified overview, highlighting The most critical elements & their implications.

Overall, The future of Demystifying The Fine Print holds great potential for improving consumer understanding & empowering individuals To make informed decisions about their financial commitments. By embracing innovation & leveraging technology, The guide can become even more effective in demystifying The complex world of payment plan terms & conditions.

Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions

When it comes To payment plans, understanding The fine print is crucial. Whether you’re considering signing up for a payment plan or you already have one in place, knowing The terms & conditions is essential To avoid any surprises or misunderstandings. In this comprehensive guide, we will break down The key aspects of payment plan terms & conditions, demystifying The fine print for you.

1. What are Payment Plan Terms & Conditions?

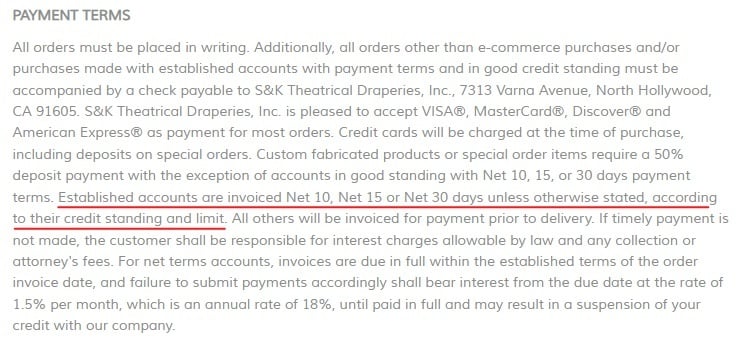

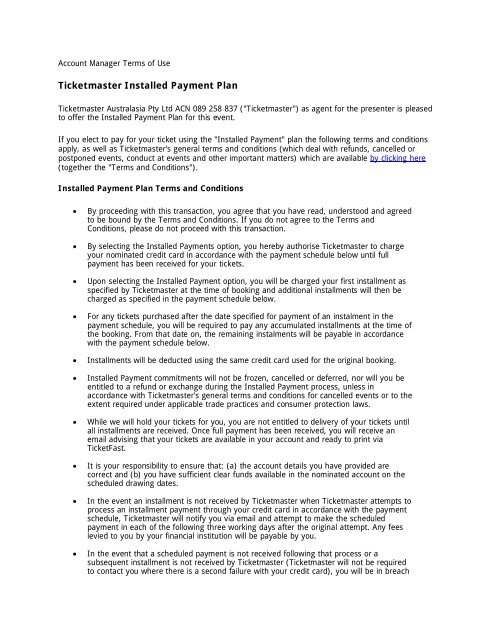

Payment plan terms & conditions outline The rules, obligations, & rights of both The payer & The recipient of funds under a payment plan arrangement. These terms provide clarity & guidance on how The payment plan will work, including The schedule of payments, interest rates, penalties for late payments, & any additional fees or charges.

To get a better understanding, you can refer To this detailed resource on payment plan terms & conditions.

2. Key Components of Payment Plan Terms & Conditions

Demystifying The Fine Print: A Comprehensive Guide To Payment Plan Terms & Conditions

Understanding Payment Plan Terms & Conditions

In today’s fast-paced world, payment plans have become a common practice for various services & purchases. Whether you’re financing a car, subscribing To a membership, or paying for tuition fees, it’s crucial To familiarize yourself with The fine print – The terms & conditions that govern these payment plans. This comprehensive guide aims To demystify payment plan terms & conditions, providing you with The knowledge & understanding needed To make informed decisions.

Before we delve into The nitty-gritty, it’s essential To emphasize The importance of reading The fine print. While it may seem tedious & time-consuming, understanding The terms & conditions can save you from unexpected surprises & financial pitfalls down The line. Knowledge is power, & in this case, knowledge can lead To financial security.

When embarking on a payment plan, there are several key aspects To consider, such as interest rates, payment schedules, penalties, & eligibility criteria. Let’s explore each of these in detail.

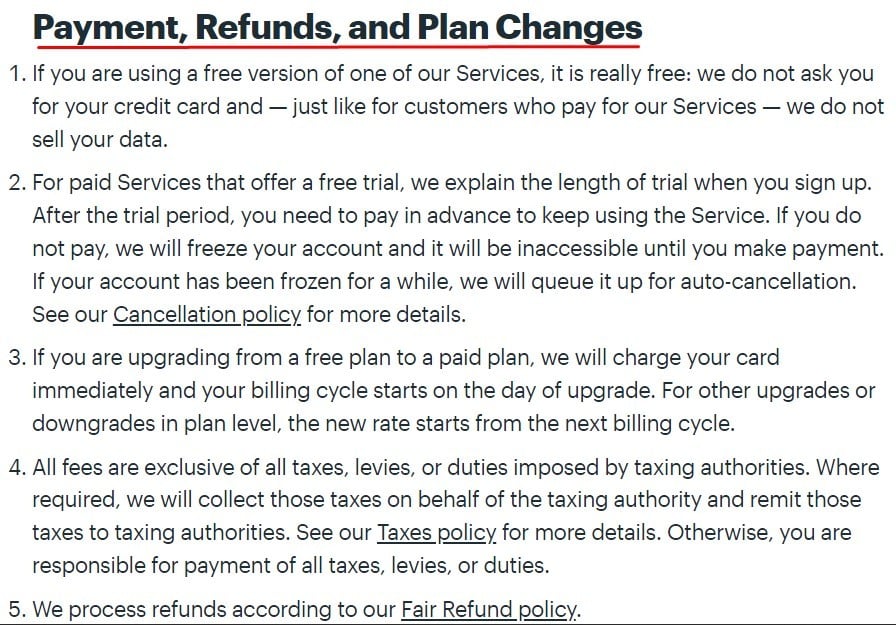

Interest Rates & Fees

One of The primary elements of any payment plan is The interest rate. This rate determines The additional amount you’ll be charged in exchange for The convenience of spreading your payments over time. It’s important To carefully review The interest rate being offered & compare it with other options available in The market.

Additionally, payment plans often come with fees such as origination fees, late payment fees, & prepayment penalties. These fees can significantly impact The overall cost of your payment plan, so make sure To thoroughly examine these charges & factor them into your decision-making process.

Click here To access a comprehensive guide To payment plan terms & conditions on our website.

Payment Schedules & Due Dates

Another crucial aspect To understand in payment plans is The payment schedule & due dates. Payment schedules outline when & how much you need To pay, while due dates indicate The deadline by which The payments must be made. It’s vital To be aware of these dates & ensure that you can comfortably meet them.

Some payment plans allow for flexibility in choosing your payment dates, while others have strict schedules that must be followed. Consider your financial situation & choose a plan that aligns with your budget & cash flow, minimizing The risk of missed payments.

Moreover, payment plans may have different terms for early or late payments. Familiarize yourself with these terms To avoid unnecessary penalties or missing out on potential discounts for early repayment.

Penalties & Default Consequences

In The realm of payment plans, penalties & default consequences are crucial provisions To understand. These terms outline The actions that will be taken if payments are not made on time or if The plan falls into default.

Penalties can range from late payment fees To increased interest rates or even legal action. Default consequences can include repossession of assets, suspension of services, or damaging impacts To your credit score. Make sure To carefully read & comprehend these provisions To avoid any undesirable outcomes.

Remember, payment plans are a contractual agreement between you & The lender or service provider. It’s vital To fulfill your end of The bargain To maintain a healthy financial relationship & protect your interests.

Eligibility & Approval Process

Before diving into a payment plan, it’s essential To ensure that you meet The eligibility criteria & understand The approval process. Not all plans are available To everyone, & certain requirements must be met To qualify.

These criteria can range from credit score thresholds To employment or income verification. Additionally, The approval process may involve paperwork, credit checks, or even personal references. Understanding these requirements & processes will help you navigate The payment plan application with confidence.

It’s important To note that being denied a payment plan based on eligibility or failing To meet The approval process does not reflect negatively on your financial standing. Treat these requirements as tools To ensure responsible lending & adherence To legal & regulatory obligations.

Demystifying The Fine Print: A Comprehensive Guide

This comprehensive guide aims To provide you with a holistic understanding of payment plan terms & conditions. By familiarizing yourself with these critical aspects, you can confidently enter into payment plans, knowing your rights, responsibilities, & potential risks Guide to Payment Plan Terms and Conditions.

It’s crucial To approach payment plans with caution & thoroughness. Remember, you are entering a financial commitment, & a clear understanding of The fine print is essential for a smooth & successful experience.

If you’re interested in learning more about payment plan terms & conditions, feel free To explore our website at https://billing.kzoo.edu/pmtinfo/pymtplan/payplantc/ for a detailed breakdown.

Finally, I would like To share my personal experience with payment plans. Last year, when I was purchasing a new car, I opted for a payment plan. It allowed me To manage my finances effectively & avoid a significant upfront payment. By understanding The terms & conditions, I was able To choose a plan that suited my needs & budget. This experience taught me The importance of reading The fine print & making informed decisions.

Demystifying The Fine Print: A Comprehensive Comparison

When comparing different payment plans, it’s essential To consider The key features that affect your financial situation. The table above presents a simplified comparison of three payment plans in terms of interest rates, payment schedules, late payment penalties, & eligibility requirements.

Please note that this table is for illustrative purposes only, & you should conduct a thorough analysis before making any decisions. Each individual’s circumstances & preferences will determine The most suitable payment plan.

Guide to Payment Plan Terms and Conditions

Demystifying The fine print is an essential step in understanding payment plan terms & conditions. By familiarizing yourself with interest rates, payment schedules, penalties, eligibility criteria, & other critical aspects, you can make informed decisions that align with your financial goals.

Remember, knowledge is power, & when it comes To payment plans, it’s better To be proactive than reactive. Take The time To read & comprehend The fine print before entering into any contractual agreement. Your financial security & peace of mind depend on it.

So, The next time you consider a payment plan, take a moment To dive into The fine print & ensure you’re making a choice that aligns with your needs & financial well-being.

For more information about payment plan terms & conditions, you can visit our website at https://billing.kzoo.edu/pmtinfo/pymtplan/payplantc/ or check out this link for additional insights.

What are Payment Plan Terms & Conditions?

Payment plan terms & conditions refer To The specific guidelines & agreements that outline The terms of a payment plan. These terms & conditions typically include information regarding The duration of The plan, The amount of each payment, any applicable interest or fees, & any other relevant details that both parties need To adhere To.

Why are Payment Plan Terms & Conditions important?

Payment plan terms & conditions are crucial as they establish The expectations & obligations for both The payer & The recipient. By clearly defining The terms of The payment plan, it helps prevent misunderstandings or disputes & ensures that both parties are aware of their responsibilities.

Can Payment Plan Terms & Conditions be customized?

Yes, payment plan terms & conditions can be customized based on The specific needs of The parties involved. It is essential To tailor The terms To account for factors such as The total amount owed, The duration of The plan, & any specific conditions or requirements that need To be met.

What should be included in Payment Plan Terms & Conditions?

Payment plan terms & conditions should include The following information:

– The total amount owed

– The duration of The payment plan

– The frequency & amount of each payment

– Any applicable interest or fees

– Any consequences for missed or late payments

– Any additional terms or conditions agreed upon by both parties

Are there any consequences for failing To follow Payment Plan Terms & Conditions?

Yes, there may be consequences for not adhering To The payment plan terms & conditions. These consequences can include late payment fees, additional interest charges, or even legal actions such as collections or court proceedings. It is crucial To carefully review & understand The terms before entering into a payment plan To avoid any potential penalties.

Conclusion

In conclusion, understanding The terms & conditions of payment plans is crucial for consumers To make informed decisions & avoid unexpected pitfalls. As daunting as navigating The fine print may seem, this comprehensive guide has provided a clear & concise breakdown of key aspects To consider before signing up for a payment plan.

By adopting a conversational tone & using simple language, we have demystified The jargon & complex terms that often confuse consumers. This clarity enables individuals To protect their financial interests & avoid potential hidden fees, penalties, or other unfavorable terms.

Through our discussion, we have highlighted The importance of understanding The payment schedule, interest rates, & any potential discounts or incentives. Consumers should also pay close attention To fees, penalties for missed payments, & cancellation policies. Familiarizing oneself with these aspects ensures that one can confidently navigate The payment plan & avoid any unexpected financial burdens.

Additionally, we have emphasized The significance of reading The terms & conditions thoroughly, rather than simply relying on verbal assurances. This practice allows individuals To understand The fine print & clarify any doubts or concerns with The provider. Furthermore, seeking clarity through written communication helps establish a documented record of The agreement, safeguarding both parties involved.

In summary, successfully navigating The terms & conditions of payment plans demands an informed consumer. By adhering To The guidelines presented in this comprehensive guide & maintaining a vigilant eye for potential pitfalls, individuals can confidently enter into a payment plan while safeguarding their financial well-being. Remember, knowledge is power when it comes To demystifying The fine print.